That's All For Now Folks! Market Expects Halt In Rate Cuts In Hungary

- 27 May 2010 2:00 AM

The Monetary Council of the Hungarian central bank will leave its key policy rate unchanged at a historic low of 5.25% next Monday (31 May), 14 out of 18 analysts forecasted in a Portfolio.hu poll on Wednesday.

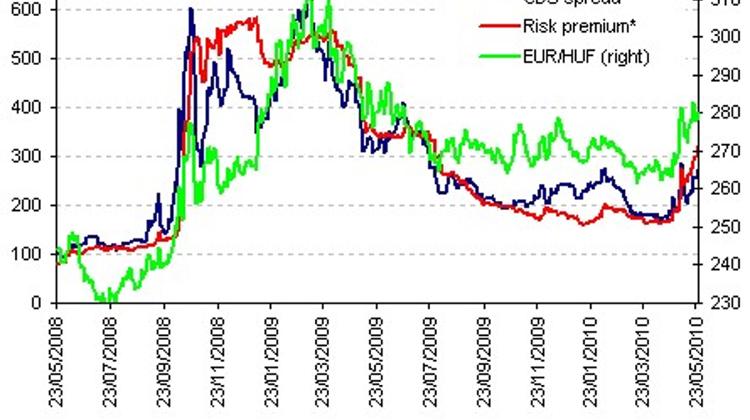

The respondents unambiguously named the worsening global environment as the main reason behind their prognosis. "Even if it does not end, the rate cut cycle will be suspended here for some time," said Dániel Orosz, strategic advisor at AXA Group in Budapest. He recalled what a roller-coaster ride Hungary’s CDS spreads had in May and that investors’ knees suddenly got wobbly at discount Treasury bill auctions.

Orosz noted that that the forint has been grappling with the 280 level against the euro ever since early May, adding that if the HUF is pushed to a range north of the room for rate cuts could be seriously narrowed.

"Further turmoil in the EU now feeding through via contagion to CDS and HUF will make it difficult for another cut though some members may well vote for a 25bp cut," said Peter Attard Montalto, analyst at Nomura in London.

Magdalena Polan, analyst at Goldman Sachs in London, said it is likely likely that the NBH will cut the policy rate for the last time next Monday to a historical low of 5.0%, "but recognise a clear risk that they may stop here or pause and deliver the final cut once the markets stabilise."

Inflation risks worth to be watched

Eszter Gárgyán, analyst at Citibank in Budapest, expects the MPC to "embed" its hold decision into its previous communication strategy.

"The official statement will probably say that based on the inflation outlook further rate cuts remain a possibility, provided that risk premia allow."

Interestingly enough, not everyone is so upbeat about Hungary’s inflation outlook.

"At the current monetary conditions the central bank’s medium-term inflation goal is in jeopardy, therefore there is a need for a higher interest rate path than what is being priced currently," said Győző Eppich, economist at OTP Bank’s analysis centre. His views chime together with those of Zoltán Árokszállási, economist at Erste Bank in Budapest.

He pointed to rate-setter Péter Bihari’s remarks last week. The MPC member said rate cuts "[...] cannot be continued at the moment. Hungary’s risk premium has deteriorated for weeks, and the inflation outlook also makes further rate cuts less justifiable."

István Horváth, head of UniCredit Bank in Hungary, also stressed the existence of CPI risks. "From an inflationary point of view it [a rate cut] is a borderline case, because in our calculations this year’s annual average inflation will come in somewhat below 5%."

"Better economic numbers and a levelling off in inflation at around 3% in the latter months of the year suggests that interest rates will bottom out at 5% - an historic low," commented Nigel Rendell, analyst at the Royal Bank of Canada in London.

"There is no need for the NBH to cut rates further in the near term. The monetary easing in recent months has been significant and the external environment now warrants caution," he added.

What next?

The lack of information about the incoming government’s fiscal plans is yet another hurdle for further monetary easing, several analysts claimed. The fiscal consequences of the new cabinet’s planned measures are unknown, bar some tiny details, said Péter Vizkelety, analyst at Generali Fund Management. This is not a good sign in light of the sovereign debt crisis in Europe and the cabinet’s communication has been working against rate cuts so far, Gárgyán at Citi said.

"Concerns about European sovereign debts, the banking systems and growth could persistently reduce liquidity on money markets. Via its export exposure and banking system Eastern Europe, Hungary specifically, may prove to be especially vulnerable that could further limit the elbow room for monetary easing. The first few remarks made by the Fidesz government point towards a rise in risk premia," she said.

As a result, Gárgyán dos not expect marked rate reduction even for the medium term, seeing room for only one more cut this year. Gábor Orbán, macroeconomist at Aegon Fund Management in Budapest is of an even less cautious viewpoint, hoping that the altered environment will not lead to a rate hike. "It would take a few years of credibility restoration, good inflation data and budget numbers before we could go further down with rates," he said.

"The political headwinds however make it doubly difficult for the MPC. Do they cut and are seen kowtowing to the incoming government to save their jobs when the contagion risk from periphery Europe are evident, or do they cut believing in their conviction around the need for further reductions and that market moves are not investors abandoning HUF but simply correlation moves?," Montalto at Nomura pondered.

Overall Montalto sees it as a pretty close vote but that "a mixture of the politics (an assertion of their independence) and contagion fears will come through with the majority of the MPC voting for unchanged."

He said he would label a cut a mistake, indeed he thinks the last cut was a mistake, leaving the currency with no risk premia left at all. "Monetary conditions are already loose enough, any further cutting would in reality have little impact on the economy," he concluded.

Regarding this year’s rate outlook, Horváth believes that "unless some serious external shock, e.g. exchange rate shock, reaches Hungary, the base rate could be left unchanged or even lowered transitionaly in a more favourable market environment. The benchmark policy rate greatly depends on imported inflation (e.g. energy), regulated prices and inflation expectations and whether they stick at the current level around 5-6%."

Despite the aforementioned risks, the consensus estimate for the end-2010 base rate remained unchanged at 5.00%."

LATEST NEWS IN business