HUF Is Critical For Hungary’s Financial Stability

- 10 Aug 2010 2:02 AM

According to a report by Hungary’s financial regulator published on Monday, NPLs rose to 8.3% in Q1 2010 from 7.8% in Q4. Household NPLs have reached 10.1% from 9.3% in Q4.

"The bad news is that the quality of loans probably continued to deteriorate in Q2 as the domestic economy remained weak and the strong appreciation of CHF/HUF (by 16% between end- March and end June) increased the burden of the loan repayments - about 60% of household mortgages are denominated in CHF," SocGen said.

SocGen believes both the bank tax and the increase in NPLs will likely delay a recovery in credit and in domestic demand.

The next quarterly banks lending survey from the National Bank of Hungary (which should be published later this month) may reflect these concerns and show persistent tight credit conditions, SocGen added.

"In this context, the level of EUR/HUF and CHF/HUF will remain a key focus for the central bank, which will likely use all its tools to prevent further significant depreciation of the HUF that would have a destabilising impact on the financial sector."

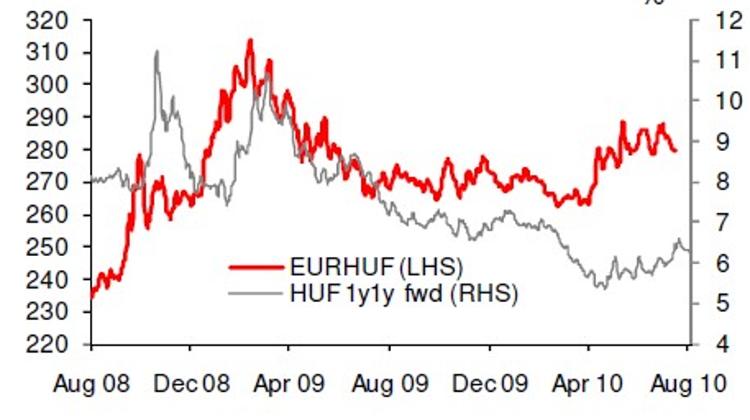

Both currency pairs have now eased after the government’s rejection of IMF conditions in June had sent CHF/HUF to a record high of 218 and EUR/HUF back to 15 month levels.

"The central bank’s threat to raise rates if needed and improved risk appetite provided some relief for the HUF. We nevertheless keep a very cautious view on the currency, as any turnaround in risk sentiment could send EUR/HUF back towards 290," SocGen said.

SG closed its 1y1y forward payer last week at 6.55% (vs 5.78% at initiation on 3 June). Local rates have rallied since late July, thanks to the strengthening HUF and improved global sentiment. "However, we still think that local rates will lag the HUF in a bullish scenario. We look for better levels to re-open this payer position in the short-end. On bonds, we maintain our cautious view for now. Despite recent good auction results, we think it is premature to turn bullish on HGBs."

Source: Portfolio Online Financial Journal

LATEST NEWS IN business