Hungary’s Central Bank Official Hints Bank’s Profits Could Be Higher

- 19 Mar 2014 8:00 AM

Before the global financial crisis, ROE of the Hungarian banking sector was around 21% while in the first half of 2013, it was down to 1.8%. The NBH staff said Hungarian banks should plough back at least half of their profits into their businesses, improving their capacity to withstand shocks and boosting their ability to lend.

The paper’s authors suggested an interest rate margin of 1-2% for corporate loans and 3-4% for home loans. The margins for corporate loans and home loans were 2.1% and 5.4%, respectively, in H1 2013. Banks’ loanto- deposit ratio should not depart for long periods from around the 100% mark.

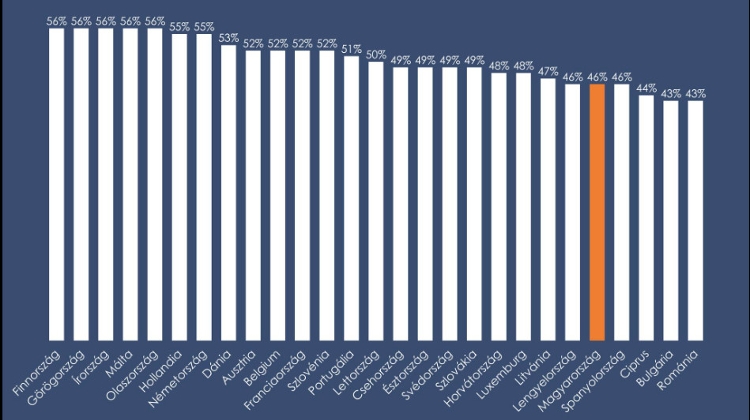

They also said the combined market share of Hungary’s biggest three banks should not exceed 50%.

The share of the three biggest banks, based on total assets, was 45% in 2013.

Source www.hungarymatters.hu

Follow that link to sign-up for MTI’s twice-daily newsletter.

LATEST NEWS IN business