Hungary Needs "Fiscal Dictatorship" - Járai

- 11 Mar 2010 1:00 AM

"We have no idea how dramatic Hungary’s [economic] situation is," Járai told a conference organized by the Confederation of Hungarian Employers and Industrialists (MGYOSZ) on Tuesday. He said the USD 25 bn IMF-led credit facility would expire after a new government takes over (centre-right Fidesz is widely expected to win in a landslide against the Socialists in April) and it remains an open issue whether Hungary could fully return to market-based financing by that time, Járai said.

The central bank has pursued a faulty monetary policy during the crisis, as it should have slashed its benchmark interest rate drastically, he added.

The Monetary Council cut its base rate by a total of 575 basis points since October 2008 when it was forced to carry out an emergency rate hike of 300 bps. Rates were as high as 10% in January 2009.

Needless to say, monetary policy can only help spur economic processes if it is coupled with an adequately disciplined fiscal policy, Járai added.

Over the past few years Hungary’s monetary policy has focused on saving FX debtors from going bust (as a result of the weakening forint), but this approach is still ruining them, because in the current recession jobs are lost and the debtors are unable to repay their loans, he said. There may still be a chance, however, to change this way of thinking and shift focus from inflation targeting to spurring economic growth, although the situation is a lot worse than before, he added.

The former NBH chief said the growth Hungary has achieved over the past ten years came at a price of massive debt accumulation.

"We will need a new convergence programme extremely soon," Járai said, adding that Hungary should not necessarily expect an upturn on its external markets in western Europe, because growth is most likely to be concentrated in Asia.

He expects an "L" shaped recovery, but noted that even this projection is surrounded by major risks, as long-term processes are very hard to forecast.

Hungary needs a budget that simultaneously aims to create balance and boost competitiveness, Járai stressed. Budget balance is a must if Hungary wants to become more competitive, but there are other crucial factors/tasks in this regard, including:

- A transparent and stable government;

- The share of GDP redistributed to households by the state should be cut by 10 percentage points to 40%. This, i.e. leaving more money in the economy, should be achieved in a dynamic process.

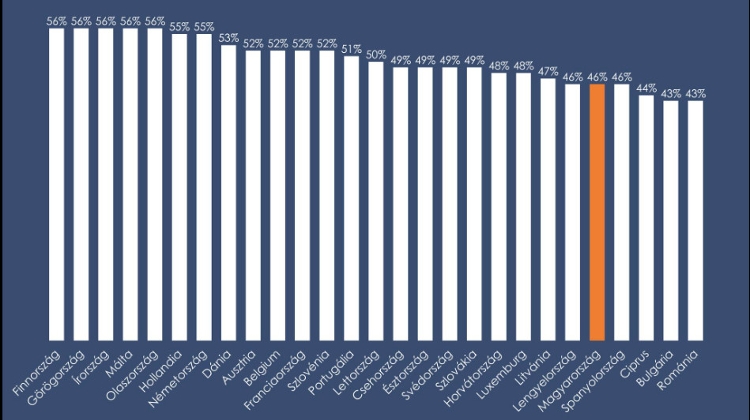

- The tax burden should be reduced to below 30% (Hungary’s regional peers have a similar tax burden and largely the same redistribution ratio). "Taxes may be cut only if spending is reduced, as well," Járai stressed. Some whitening of the grey economy should also be expected, and this could even increase tax revenues. "So the first step is to cut spending and than from higher tax revenues you can finance higher redistribution.";

lower tax rates; simpler and more transparent tax regime to widen the taxpayers’ base.

- It is not sufficient to lower the budget deficit to the Maastricht criterion (3.0% of GDP). Hungary needs a balanced budget, moreover, a budget surplus. This is what will allow the government debt to be reduced gradually.

- Social spending and red tape need to be cut. Hungary should switch to e-governing and close a host of public offices, Járai said.

- Corruption must be fought hard.

- Innovation and a boost to employment are also key. The target to create one million jobs over a ten-year period is a realistic goal, Járai said. (This objective was set by Fidesz). To the EU Hungary pledged to boost the rate of employment by 70% in a few years. This translates into about one million jobs, he added.

- Bank system, monetary policy. The double whammy coming from a simultaneous fiscal and monetary restriction is "simply shocking". And inflation is not even a real danger today, "these are different times", Járai said. Economic recovery may start only if monetary policy is willing to do its part. Of course, this requires consolidated fiscal policy.

- Hungary needs to join the euro zone as soon as possible. This would be beneficial for all of us, and - among others - it would lead to lower rates, Járai said. You need to keep in mind, though that you cannot adopt a strong currency (i.e. the euro) in a weak economy. "Hungary is immature for euro adoption. Our task is not to convince the euro zone to let us in. First we need to prepare the economy to function dynamically competitively," Járai said."

LATEST NEWS IN business