Euro Adoption Five Years Away For Hungary - Again

- 26 Apr 2010 5:00 AM

No major changes can be observed in the estimates from a month ago. The most apparent shift is the already large majority of those who project a miss of the central bank’s 3.0% goal. While the Dec/Dec CPI print will be within the +/-1 ppt "tolerance range", the consensus jumped to 3.55% from 2.9% in March.

As the year progressed, the median forecast for Hungary’s budget deficit crept higher. This month it came to 4.9% of GDP, against the government’s 3.8% target. The consensus estimate was for a deficit of 3.9% just four months ago. The question is how much of this shortfall the analysts attributed to the possible consolidation of the debt of state-owned enterprises. Gergely Forián Szabó, investment director at Pioneer Fund Management, believes the gap could be as wide as 6.0% of GDP if the government decides to assume 1.6% of the quasi fiscal losses.

These uncertainties, though are not material enough for the central bank to suspend its rate cut cycle, the economists in the poll projected. Their caution, however, is palpable considering that none of the respondents forecasted a 50-bp cut to the benchmark rate, while it was a very close call in March to lower the base rate by 25 bps and not 50 bps. The minutes of that meeting showed four MPC members voting for a more moderate easing and three supporting a more aggressive cut.

In the poll conducted on April 19-21, 23 out of 27 analysts forecast a quarter percentage point cut to 5.25%, while four analysts expected the bank to keep rates unchanged.

This outcome chimes together with the result of a Portfolio.hu poll published earlier this week.

Tame inflation gives the central bank room to cut rates, Reuters said, adding that the NBH also needs to ease policy "to soothe a likely post-election forint surge which could hit exporters and create the risk of a later sharp reversal."

Local markets have priced in a quarter percentage point cut, and are unlikely to react if it is delivered, dealers said.

Most analysts said the bank had no reason to keep rates on hold after cutting them every month since July, as long as investor appetite for forint assets does not fall.

"The bank remains firmly in easing mode: its modus operandi is the following: the CPI and GDP outlook still suggest cuts ahead," said Morgan Stanley's Pasquale Diana in a note following a visit to the NBH last week.

A decision to keep rates on hold could strengthen the forint and trigger a sell-off in the government debt market.

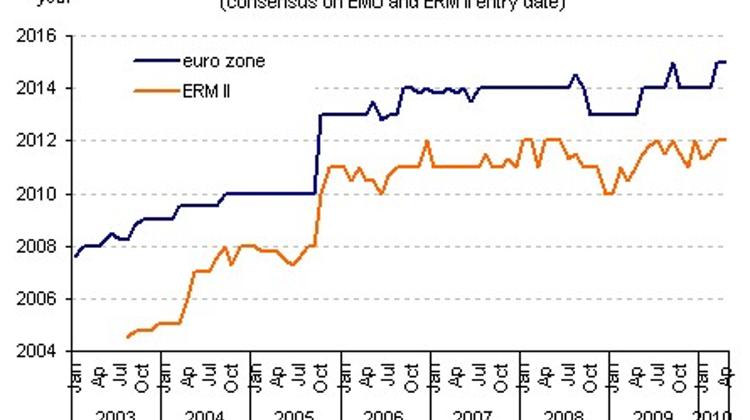

Local politicians have been addressing the country’s desired euro zone accession more and more frequently, now that Hungary is choosing a new government. This probably had a lot do with the fact that the consensus forecast for Hungary’s EMU entry came to 2015 against 2014 previously for the second month in a row. The median forecast for ERM-2 membership remains 2012.

With this result we arrive at the old conclusion that said Hungary is always five years away from the adoption of the single European currency. This phenomenon came to an end in 2006 when the market turned disappointed enough to put the likely date of euro zone accession from 2010 right to 2013-14. From then onward the estimate has been stable for a long time, but now that the five-year distance would have shortened, the median prognosis rose to 2015."

LATEST NEWS IN business